Buoyed by recent investments from Warren Buffett in Japanese trading companies, a weak yen, and a surge in tourism, the Japanese stock market has reached its highest point in 30 years. Many respected analysts are predicting a continuation of the booming market and increased attention on the opportunities in the Japanese market.

However, entering the Japanese market comes with its fair share of challenges. From cultural nuances to regulatory complexities, there are several bottlenecks that companies must navigate to establish a successful presence in Japan. This article will explore these challenges while exploring the opportunities for businesses willing to adapt and localize their strategies.

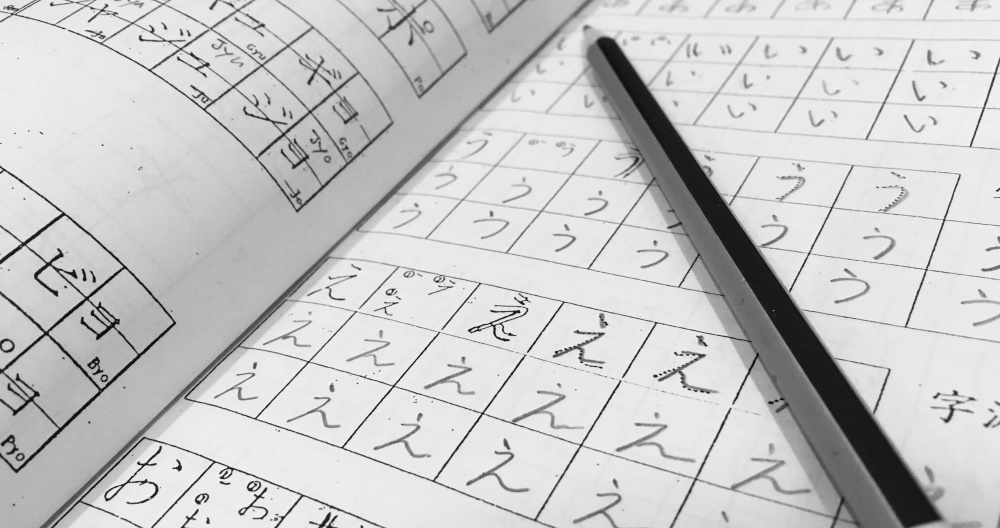

Language and Cultural Barriers

One of the primary challenges for foreign businesses in Japan is the language barrier. While English is taught in schools, fluency levels among the general population may not be sufficient for conducting business. Japanese is the predominant language used in the corporate world, making effective communication essential for building relationships with local partners and clients. Understanding and respecting Japanese business etiquette, customs, and cultural nuances is crucial for successful market entry.

To overcome these barriers, companies should invest in language training for their employees or hire bilingual staff who can bridge the communication gap. Additionally, conducting thorough research on Japanese business culture and consulting with local experts can help businesses navigate the cultural landscape, building credibility and trust with potential partners and customers.

Complex Regulatory Environment

Japan has a complex regulatory environment, posing significant challenges for foreign businesses. Strict regulations and requirements exist across various sectors, from product certifications to licensing procedures. Navigating these regulations can be time-consuming and costly, particularly for companies unfamiliar with the Japanese regulatory landscape.

To overcome regulatory challenges, businesses must conduct comprehensive research on the regulatory requirements specific to their industry before entering the market. Engaging local legal and consulting firms with expertise in Japanese regulations can provide valuable guidance and ensure compliance. Building solid relationships with local authorities and industry associations can also help streamline the regulatory process.

Established Market Players

Japan boasts a strong domestic market with well-established players who enjoy brand loyalty and long-standing supplier relationships. Competing against these established companies can take time for new entrants. However, there are opportunities for businesses to differentiate themselves in the market. Thorough market research can identify gaps or unmet needs, enabling companies to offer unique products or services that cater to specific customer demands. Building strategic partnerships with local companies or distributors with existing networks and market knowledge can also provide a competitive advantage.

Aging Population and Shifting Demographics

Japan’s rapidly aging population presents challenges and opportunities for businesses entering the market. With a significant proportion of elderly individuals, there is a growing demand for products and services tailored to their needs, such as healthcare, assistive devices, and leisure activities. According to the Ministry of Internal Affairs and Communications in Japan, as of 2021, around 28% of the population is 65 years or older. By 2036, nearly 40% of the population is projected to be elderly.

To capitalize on this demographic shift, businesses should adapt their strategies to cater to the unique requirements of the aging population. Developing innovative solutions, collaborating with healthcare providers, and leveraging technology to enhance the quality of life for seniors can unlock significant market potential.

Competition: Established Players and Customer Loyalty

Japanese consumers place a strong emphasis on brand loyalty and reputation. Building trust and establishing a positive brand image is crucial for market entry success. According to a survey by Nielsen, Japanese consumers ranked brand reputation as the most critical factor influencing their purchasing decisions. Breaking into the market requires innovative solutions, unique value propositions, and strategies to differentiate from the existing players. Building trust and establishing a strong reputation takes time; companies must be prepared for intense competition.

E-commerce Growth

The e-commerce market in Japan has experienced substantial growth, providing new avenues for market entry. With high internet penetration and tech-savvy consumers, online platforms and marketplaces offer opportunities for businesses to reach a broader customer base. According to Statista, the e-commerce market in Japan was valued at approximately 22 trillion Japanese yen (around $200 billion USD) in 2020.

To tap into the e-commerce market, companies should establish a strong online presence, optimize their websites and product listings for the Japanese market, and leverage digital marketing strategies to attract and engage customers. Partnering with local e-commerce platforms and logistics providers can enhance distribution and customer reach.

Technological Advancements and Innovation

Japan’s reputation as a global leader in technological advancements and innovation presents opportunities for businesses with cutting-edge technologies and solutions. The level of the financial infrastructure often needs to be updated, which can surprise entrants to Japan. Companies may struggle with building and integrating new systems with legacy systems, which can be costly and time-consuming.

To leverage this opportunity, companies should highlight their technological expertise and emphasize their innovations’ benefits to the Japanese market. Collaborating with local research institutions, industry associations, and technology partners can facilitate knowledge exchange and enhance market entry prospects.

Cybersecurity Concerns: Protecting Customer Data

Japan places a strong emphasis on cybersecurity, and fintech companies must prioritize the protection of customer data and prevent cyber attacks. Ensuring compliance with data protection regulations and implementing robust security measures is paramount. However, startups with limited resources may need to allocate funds and expertise to address cybersecurity concerns. Failing to meet Japan’s stringent cybersecurity standards can impede market entry and lead to reputational damage and legal repercussions. According to the Ministry of Economy, Trade, and Industry (METI), the number of reported cyber attacks in Japan reached a record high of 14,000 cases in 2020, highlighting the need for robust cybersecurity measures.

To address these concerns, businesses must prioritize cybersecurity measures such as robust encryption protocols, secure data storage, regular vulnerability assessments, and employee training on best practices. Implementing a multi-layered security framework, including firewalls, intrusion detection systems, and endpoint protection, can help mitigate risks. Furthermore, businesses should stay updated on the latest cybersecurity trends, collaborate with industry experts, and establish incident response plans to address potential breaches swiftly. By adopting a proactive approach and investing in comprehensive cybersecurity measures, businesses in Japan can demonstrate their commitment to protecting customer data and instill confidence in their services.

Cultural Preferences and Localizing Strategies

Understanding and adapting to Japanese cultural preferences is vital for successful market entry. Japanese consumers appreciate products and services tailored to their specific needs and tastes, and they value attention to detail, quality, and a sense of tradition. According to a survey by McKinsey & Company, around 70% of Japanese consumers prefer products tailored to their specific needs and tastes.

Companies should invest in market research to understand customer needs, preferences, and price sensitivity to cater to these preferences. Localization efforts should extend beyond language translation to include product adaptation, packaging, and marketing strategies that resonate with Japanese consumers. Demonstrating a commitment to the Japanese market and building long-term relationships based on trust and reliability are also crucial.

Customer Acquisition: Building Trust and Relationships

Building a customer base in Japan can be particularly challenging for foreign companies. Japanese consumers tend to be loyal to established brands, making it difficult for newcomers to gain traction. Many Japanese brands are active in many different sectors. For instance, GMO, a leading internet service provider, is active in online payments and the financial industry. Consumers also highly value in-person relationships and trust, which can be challenging for digital-only fintech companies to replicate. Building trust and establishing relationships with Japanese consumers often requires a long-term commitment and investment in local partnerships and marketing strategies tailored to the specific preferences of the target audience.

While entering the Japanese market poses challenges, it also offers significant opportunities for businesses willing to understand and adapt to the market’s unique characteristics. Overcoming language and cultural barriers, navigating the regulatory landscape, and differentiating from established players are critical to success. Leveraging demographic shifts, embracing e-commerce, capitalizing on technological advancements, and localizing strategies can help businesses unlock the vast potential of the Japanese market. Companies can establish a strong and sustainable presence in Japan by embracing these challenges and opportunities.